SBI Shishu Mudra Loan: SBI Shishu Mudra Loan Scheme is being run by State Bank of India. Through SBI Shishu Mudra Loan Scheme bank provides Mudra loans from Rs 50,000 to Rs 1,00,000 to customers for small and big business.

In this article we will tell you how to apply online for SBI Shishu Mudra Loan (SBI Shishu Mudra Loan Yojana) and what are the rates. Follow the below process for fast loan approval.

Mahila Samriddhi Loan Yojana: Get Rs.1.25 Lacs Loan

SBI Shishu Mudra Loan Yojana Official Portal

Table of Contents

Overview of SBI Shishu Mudra Loan

| Article Name | SBI Bank is Offering Mudra Loan of Rs 50,000 |

| Yojana Name | SBI Shishu Mudra Loan Yojana |

| Launched By | Govt of India |

| Beneficiary | Providing Loans |

| Benefit | Get Loan Up to Rs. 50K |

| Toll Free No. | 18003454545 |

| Official Portal | Click Here |

Eligibility Criteria

- (SBI Shishu Mudra Yojana) To apply for SBI Shishu Mudra Loan you must be an Indian citizen.

- In this scheme your age should be between 18 years to 60 years.

- Your business should be registered, if not then you can’t avail the benefit of this scheme.

- To avail the benefit of Shishu Mudra Loan Scheme you must have an account with State Bank of India which is more than 6 months old.

- Applicant for Shishu Mudra Loan Scheme should not be a defaulter in loan, if you are defaulter then your application form in this scheme will be rejected.

Documents Requirement

- Aadhar Card

- PAN Card

- Business Certificate

- Income Certificate

- Bank Account Passbook

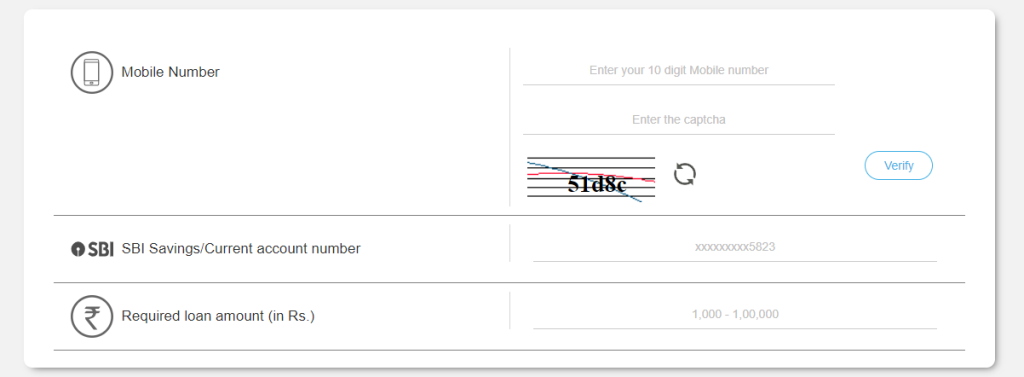

- Mobile Number

How to Apply?

We have told you the step by step process to apply for SBI Shishu Mudra Loan Yojana, follow it and apply:

- Step 1 – Check if you are registered on Jan Samarth portal or not, if registered then apply from SBI Bank website.

- Step 2 – Click on Business on the bank website.

- Step 3 – Now you will see SME, click on PMMY in government scheme.

- Step 4 – A new page will open in front of you, you will be redirected to another page through Jan Samarth portal.

- Step 5 – Then click on Schemes, then choose Business Activity Loan.

- Step 6 – A new page will open in front of you, choose PMMY.

- Step 7 – You will see the eligibility for Shishu Mudra Loan Yojana, if yes then you will get the login option, click on it.

- Step 8 – You can apply in this scheme only after login.

- Step 9 – If you are applying online then you will get Mudra loan up to Rs 50,000, if you are applying through bank branch then you will get Mudra loan up to Rs 1,00,000.

FAQs About SBI Shishu Mudra Loan Yojana

What is SBI Shishu Mudra Yojana?

SBI Shishu Mudra Yojana is a Mudra loan scheme under Pradhan Mantri Mudra Yojana (PMMY) by State Bank of India (SBI) for micro enterprises. It provides loans up to ₹50,000 to non-corporate, non-farm small/micro enterprises in the country.

Who can apply for SBI Shishu Mudra Yojana loans?

Any Indian citizen having a business plan for a non-farm income generating activity like manufacturing, processing, trading or service sector whose credit need is less than ₹50,000 can apply for SBI Shishu Mudra loans. As usual SBI terms and conditions will apply.

What documents are required for SBI Shishu Mudra Yojana loans?

One page application form, address proof, identity proof, bank statement for a defined period, statutory returns and any other documents as required by SBI. No collateral is required.

What is the turnaround time for SBI Shishu Mudra Yojana loan proposals?

Seven to ten days for Shishu loans after receipt of complete information.