SBI Kisan Credit Card: Kisan Credit Card is very useful in making farmers self reliant today. With its help farmers get help in ploughing or buying seeds etc. to grow crops. Modi government is running Kisan Credit Card Yojana to make farming worry free for farmers.

Under this scheme if farmers open an account in SBI or any other bank then they get Rs 3 lakh. Ministry of Agriculture and Farmers Welfare tweeted that the objective of Kisan Credit Card Scheme is to provide loans to farmers at low interest rate through banking channel for their farming and other works. Follow the below process for fast loan approval.

Get Rs.50,000 Loan For Starting Your Business, Apply Online

SBI Kisan Credit Card Online Apply Official Site

Table of Contents

Overview of SBI Kisan Credit Card

| Article Name | Farmers Will Get Loan Up to Rs.3 Lacs at 2% Interest Rate |

| Yojana Name | SBI Kisan Credit Card |

| Launched By | Govt of India |

| Beneficiary | Providing Loans to Small Farmers |

| Benefit | Get Loan Up to Rs.3 Lacs |

| Official Portal | Click Here |

How to Get Benefits of SBI Kisan Credit Card

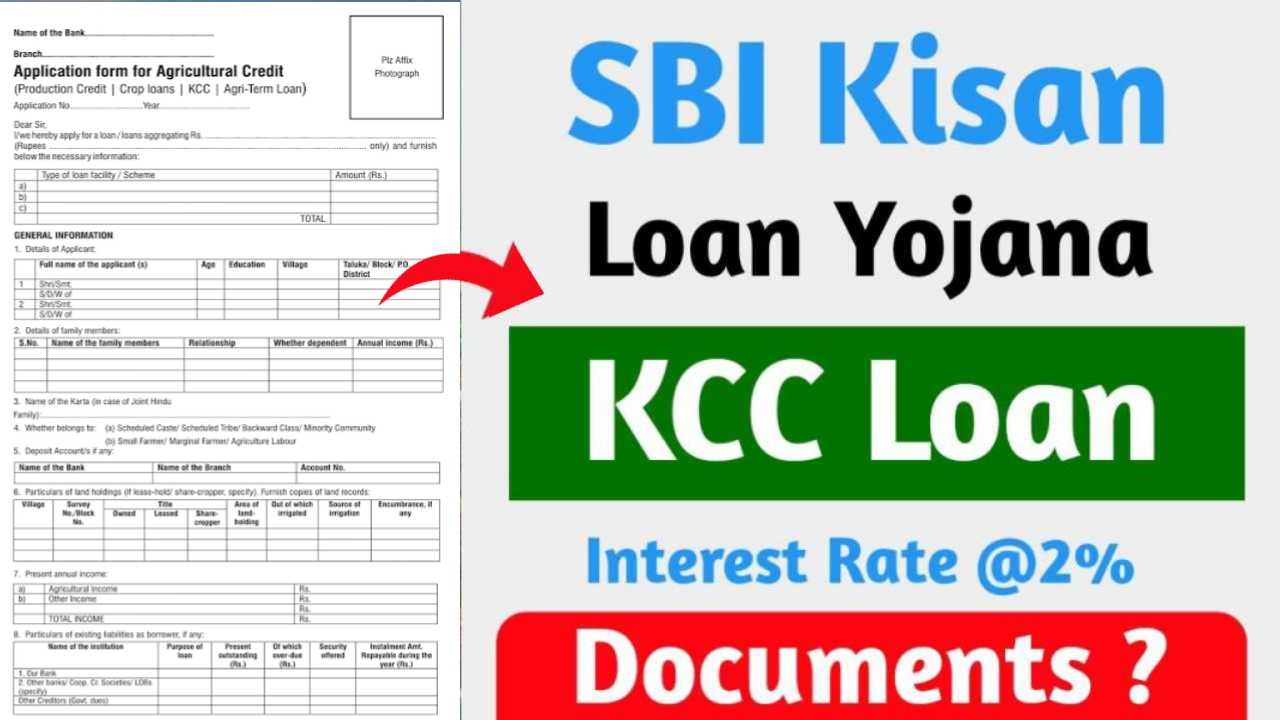

To avail this scheme you have to download KCC scheme form from PM Kisan official portal. To get the benefit of this scheme farmer must have Aadhar card, PAN card. Farmer has to submit the form along with Aadhar card, PAN card and a photo in the bank. Farmer can open an account in any SBI, Bank of Baroda or any other bank. When money comes in Kisan Credit Card account then you can transfer the money to your account.

Eligibility Criteria

- 18 to 75 years at loan maturity. If above 60 years, co-borrower should be below 60 years.

- 2 acres of irrigated land minimum and 1000 acres maximum.

- Bank will verify the income.

- Bank will check the credit score before sanctioning the card.

- Owner cultivator, tenant farmer, oral lessee, share cropper, involved in crop production or related activities.

Documents Requirement

- Aadhar Card

- PAN Card

- Bank Passbook

- Income Certificate

- Residence Certificate

- Caste Certificate

- Land Papers

- Mobile Number and Photo

Interest Rate

If you also take a loan from Kisan Credit Card Yojana then you must know its interest rates and you must remember the date on which you took the loan. You have to repay the loan along with the interest before one year of the date on which you took the loan. By doing this you become eligible to take the loan from next day.

If you do this then you get 3% interest subsidy on loans up to Rs. 3 lakh from government so it is called the best loan of the country. Kisan Credit Card interest rate is 9% in which 2% is given by Central Government. Apart from this if you repay the loan before one year then you also get 3% incentive.

Apply for SBI Kisan Credit Card

To get KCC benefit the farmer will have to download KCC form from PM Kisan portal. Apart from Aadhaar card, PAN card and one of his photo the farmer will have to fill the form and deposit it in the nearest State Bank of India (SBI) and then the amount will be credited in his account.

FAQ Related SBI Kisan Credit Card

What are the objectives of Kisan Credit Card Scheme?

Kisan Credit Card (KCC) scheme is to provide timely and adequate credit to farmers to meet their production credit needs (cultivation expenses) besides meeting contingency expenses and expenses related to ancillary activities through a simple process.

Who are the eligible borrowers under KCC scheme?

Eligible borrowers under KCC scheme are individual farmers who are owners/cultivators, sharecroppers, tenant farmers, Self-Help Groups (SHGs) of farmers, Joint Liability Groups (JLGs), fishermen, poultry farmers, dairy farmers and others engaged in agricultural and allied activities.

What are the facilities available under KCC scheme?

Under KCC scheme farmers can get short term credit for cultivation of crops, post harvest expenses, produce marketing loans, consumption requirements of farm households and working capital for maintenance of farm assets and allied activities.