PM Mudra Loan: Government has launched a loan scheme for all the citizens of the country to start their own business, named Pradhan Mantri Mudra Loan Yojana. This scheme has been launched by our Prime Minister, Narendra Modi. If you want to start a new business or want to take your business further, then you can take a loan from Rs 50000.00 to Rs 10 lakh through PM Mudra Loan Yojana.

Through this scheme, government is now giving loans to all the needy citizens with some easy terms and conditions of the banks. If you are unemployed and you don’t have enough money to start your own business, then this is a golden chance for you, you can start your own business by taking a loan under Pradhan Mantri Mudra Loan Yojana 2024 launched by PM Modi. Follow the below process for fast loan approval.

Kisan Credit Card: Get Loan at Lowest Interest Rate

PM Mudra Loan Yojana Online Registration Official Portal

Table of Contents

Overview of PM Mudra Loan

| Article Name | Get Rs.10 Lacs Loan For Your Business |

| Yojana Name | PM Mudra Loan |

| Launched By | Govt of India |

| Beneficiary | Micro Entrepreneur in India |

| Benefit | Get Loan Up to Rs.10 Lacs |

| Official Portal | Click Here |

If you don’t know about this scheme then today through this article we will give you full information about PM Mudra Loan Yojana 2024. We will tell you how much loan will be available under Pradhan Mantri Mudra Loan Yojana and types of loans and how to apply to get benefit of PM Mudra Loan Yojana in this article.

What is PM Mudra Loan Scheme

Good news for those unemployed citizens of the country who haven’t started any business yet because of lack of funds and want to start further. Now government will give them a loan of up to Rs 10 lakh under PM Mudra Loan Scheme. Which will be credited directly in the bank account of the beneficiary. But for this they will have to apply in PM Mudra Loan Scheme.

You can use the loan taken through PM Mudra Loan Yojana to start a new business or to take your business further. This scheme will be very beneficial for those citizens of the country who are still unemployed because of not getting a job, they can start their business by taking a loan through this scheme, we will tell you more about it.

Benefits of PM Mudra Loan Yojana

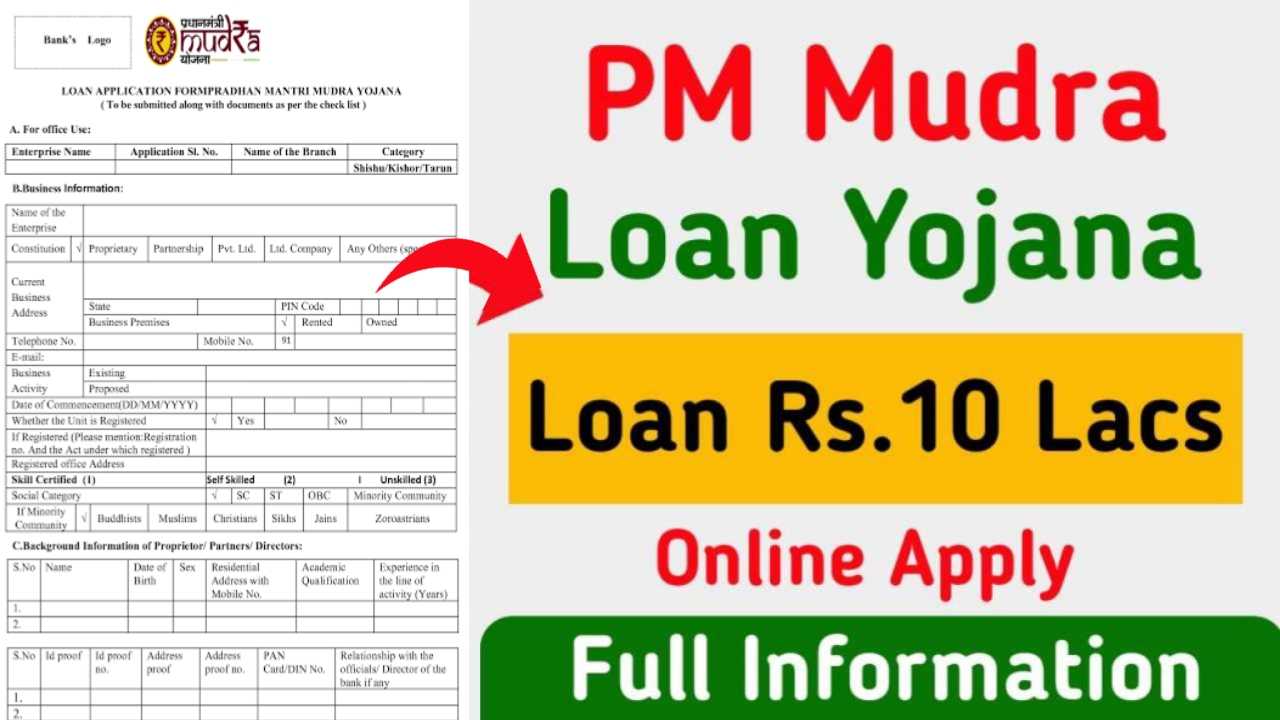

If you want to take a loan under PM Mudra Loan Yojana then first of all let us tell you that under this scheme three types of loans (Shishu, Kishor and Tarun) are given. Which is explained below:

- If you want to take a loan under Shishu Loan and apply, then you will get up to ₹ 50,000.

- If you apply for Kishor Loan Ithat Loan, then you will get 50,000 to 5 lakhs.

- If you apply for a loan under Tarun Loan, then you will get a loan of Rs 5 lakh to Rs 10 lakh.

Online Apply For PM Mudra Yojana

If you want to apply online under PM Mudra Loan Yojana and take a loan then you can apply by following the steps below:

- To apply for PM Mudra Loan Online first go to its website.

- When you reach the homepage of this website you will see three options Shishu, Tarun and Kishor.

- Whatever loan you want to take you have to click on that.

- As soon as you click on any option the related application form link will open in front of you.

- Now here you have to download the PM Mudra Loan Yojana application form by clicking on download option.

- After downloading the application form take a print out of it.

- After this read all the information asked in the application form carefully and fill it correctly.

- After filling the application form completely attach all the required documents asked in it.

- Now submit this application form to your nearest bank.

- After that bank employees will approve your application. Then you will get PM Mudra Loan Yojana.

FAQ Related PM Mudra Yojana

What is PMMY?

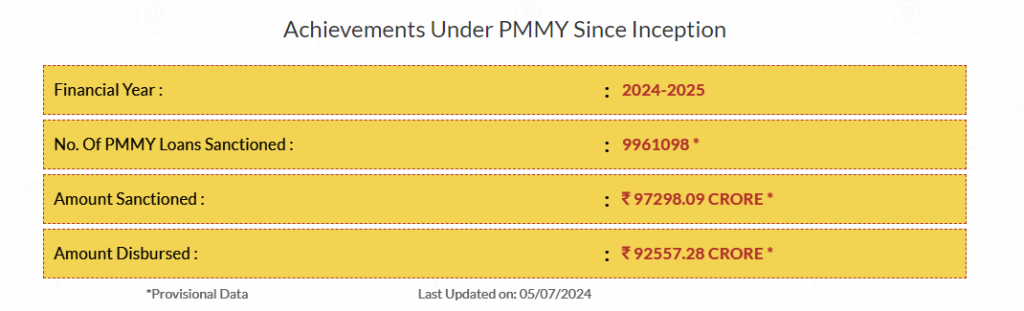

PMMY is a scheme launched by Government of India to provide loans up to ₹10 lakhs to non-corporate, non-farm small/micro enterprises. It aims to fund the unfunded by providing access to affordable credit to small businesses.

Who are the target borrowers under PMMY?

The target borrowers are non-corporate small businesses like proprietorship firms, partnership firms, private limited companies, public companies and other legal forms. They should be engaged in manufacturing, processing, trading or service sector activities with loan requirement of less than ₹10 lakhs.

What are the loan categories under PMMY?

The three loan categories under PMMY are:

1. Shishu: Loans up to ₹50,000

2. Kishor: Loans above ₹50,000 and up to ₹5 lakhs1

3. Tarun: Loans above ₹5 lakhs and up to ₹10 lakhs

Is Khadi activity eligible under PMMY?

Yes, Khadi activity is eligible under PMMY as it falls under the textile sector which is one of the focus sector under the scheme.

Can PMMY loans be used for purchase of CNG tempo/taxi?

Yes, PMMY loans can be used for purchase of CNG tempo/taxi if the applicant intends to use the vehicle for commercial purpose.