PM Home Loan Subsidy Yojana: PM is going to launch PM Home Loan Interest Subsidy Scheme for low income group people living in rented houses or kutcha houses in urban areas, under this scheme low income people of the country will get 3% to 6.5% interest subsidy every year on home loans up to Rs 50 lakh for 20 years and this amount will be credited directly in their bank account.

Under PM Home Loan Subsidy Yojana, loan up to Rs 9 lakh can be given and beneficiaries will get interest subsidy every year. Also for this the government has decided to spend Rs 60,000 crore which will benefit 25 lakh home loan applicants, for more information read below. Follow the below process for fast loan approval.

Get Rs.30000 For Opening New Business, Loan From Govt

PM Home Loan Subsidy Yojana official Portal

Table of Contents

Overview of PM Home Loan Subsidy Yojana

| Article Name | Get Rs.50 Lacs Loan Subsidy by Govt |

| Yojana Name | PM Home Loan Subsidy Yojana |

| Launched By | Govt of India |

| Beneficiary | Providing Loans For Home |

| Benefit | Get Loan Up to Rs. 50 Lacs |

| Toll Free No. | 1800-11-3377 |

| Official Portal | Click Here |

Features and Benefits of PM Home Loan Subsidy Yojana

- Preparations are underway to launch PM Home Loan Interest Subsidy Scheme for those living in cities who live in rented houses, kutcha houses or slums.

- Under this scheme home loans will be given to low income group people at low interest rates.

- Under the scheme these families will get 3% to 6.5% interest subsidy on home loan of Rs 9 lakh.

- Interest subsidy will be transferred directly to the beneficiary’s bank account.

- 25 lakh home loan applicants will get the benefit of this scheme and government will spend Rs 60,000 crore in 5 years.

Eligibility Criteria

To avail PM Home Loan Subsidy Scheme you need to take care of the following eligibility criteria:

- Citizens of all religions and castes can apply under PM Home Loan Subsidy Scheme.

- Benefit of this scheme will be available only to people of weaker sections who live in rented houses, kutcha houses, chawl or slums in the city.

- Benefit of the scheme will be available to those who have not availed Pradhan Mantri Awas Yojana.

- To avail benefit under PM Home Loan Subsidy Scheme applicant must have bank account linked to Aadhar card.

- Candidate should not be declared defaulter by any bank.

Documents Requirement

- Aadhar Card

- Residence Certificate

- Caste Certificate

- Driving License

- Income Certificate

- Bank Passbook

- Email ID

- Mobile Number

- Passport Size Photo

How to Apply in PM Home Loan Subsidy Yojana

Wait for a while to apply under PM Home Loan Subsidy Yojana 2024 as the preparations are going on to launch the scheme. Soon the cabinet will approve the scheme and then the application process will start under this scheme and then you can apply. Till then wait, as soon as any official announcement is made by the government we will update here.

FAQ Related PM Home Loan Subsidy Yojana

Who is eligible for PMAY home loan subsidy?

You must be an Indian citizen with an annual household income between ₹0-18 lakhs (EWS, LIG, MIG I, MIG II). You should not own a pucca house in India and meet the carpet area and location criteria for the property.

How much is the maximum loan eligible for subsidy?

Maximum loan eligible for subsidy is ₹6 lakhs for EWS/LIG, ₹9 lakhs for MIG I, ₹12 lakhs for MIG II. But the carpet area of the property should not be more than 30 sq.m for EWS, 60 sq.m for LIG, 160 sq.m for MIG I, 200 sq.m for MIG II.

What is the interest subsidy under PMAY?

Interest subsidy is 6.5% for EWS/LIG, 4% for MIG I, 3% for MIG II. Subsidy is available for maximum loan tenure of 20 years.

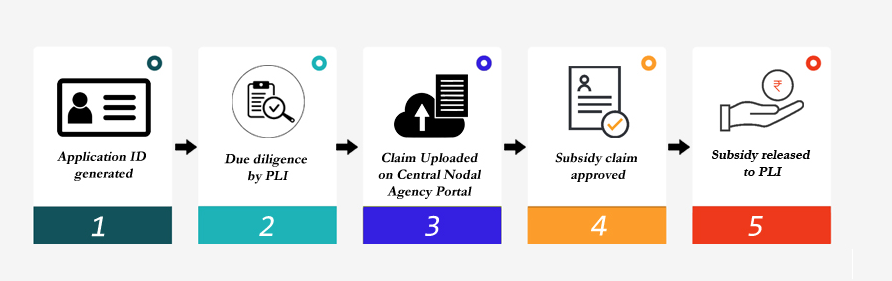

How to apply for PMAY home loan subsidy?

Login to PMAY website, select benefits under Credit Linked Subsidy Scheme (CLSS) component, enter your Aadhaar details, fill the application form correctly and submit online. No application charges for online process.