Mahila Samriddhi Loan Yojana: Central and state government in the country have various schemes for different categories. Many Mahilaakshi schemes are implemented by Women and Child Development Department. Like Widow Assistance Scheme, Wali Beti Scheme, Beti Bachao Batti Padhao Scheme etc. Loan schemes like Mahila Swavalamban Yojana are also implemented for self employment.

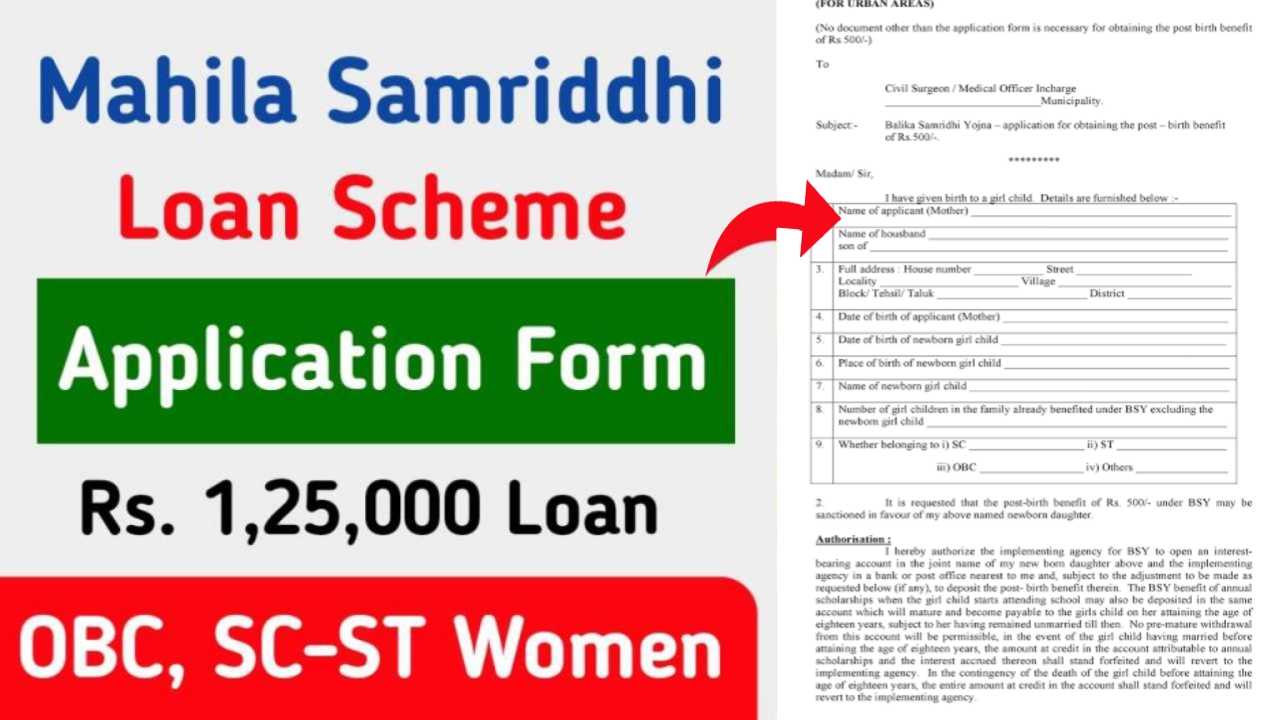

Mahila Samriddhi Loan Yojana was launched on 2 October 1993. But today we will talk about a scheme which takes women towards prosperity. Named Mahila Samriddhi Yojana. (Mahila Samriddhi Yojana Scheme) Women get benefits under this scheme. Follow the below process for fast loan approval.

Farmers Will Get Loan Up to Rs.3 Lacs at 4% Interest Rate

Mahila Samriddhi Loan Yojana Online Registration Official Portal

Table of Contents

Overview of Mahila Samriddhi Loan Yojana

| Article Name | Get Rs.1.25 Lacs Loan, Application Form, Documents List |

| Yojana Name | Mahila Samriddhi Loan Yojana |

| Launched By | Govt of India |

| Beneficiary | Providing Loans to Women |

| Benefit | Get Loan Up to Rs.1.25 Lacs |

| Toll Free No. | 18001023399 |

| Official Portal | Click Here |

What is Mahila Samriddhi Loan Yojana

Mahila Samriddhi Yojana is a government scheme. Mahila Samriddhi Yojana is also asked in UPSC. Loans are given to women through Mahila Utkarsh Yojana and Mahila Swavalman Yojana. But this scheme is for those women entrepreneurs who belong to backward or poor families. They will be given financial assistance.

This scheme was launched by National Backward Classes Finance and Development Corporation (NBCFDC) under Ministry of Social Justice and Empowerment. Under this scheme government provides microfinance to women entrepreneurs directly or through self help groups (SHGs). Information is also available in Mahila Samriddhi Loan Yojana Wikipedia website.

Objective of Mahila Samriddhi Yojana

To promote women entrepreneurs and their businesses, Ministry of Social Justice and Empowerment, Government of India has launched a scheme – Mahila Samriddhi Yojana. Under this scheme, government provides financial assistance to women entrepreneurs who belong to marginalized sections of the society.

Women from backward sections are the main target of the program, especially those who are SC/ST. Micro credit is given to create self employment for women from backward classes. Under this scheme, female beneficiary can do any business of her choice.

Eligibility Criteria

This Mahila Samriddhi Yojana 2024 will be beneficial to all the women who are below poverty line. Below are the eligibility criteria for such women to join this scheme.

- Minimum age under Mahila Samriddhi Yojana is 18 years.

- Maximum annual family income of the applicant should not exceed Rs. three lakhs.

- Annual household income of the applicant should not exceed Rs.3,00,000/-.

- Applicant can be part of Self Help Groups (SHGs).

- At least 60% of the members should be from backward classes and 40% from other weaker sections like physically handicapped women, minorities, SC, ST etc.

- Loan should not have any other criminal cases or criminal history.

Documents Requirement

- ID Proof

- Residence Certificate

- SHG ID

- Caste Certificate (if applicable)

- Income Certificate from a higher authority

- Bank Account Details

- Income Certificate from a higher authority

- Aadhaar

- Recent Photo

Benefits of Mahila Samriddhi Loan Yojana

- It empowers women to be self sufficient.

- Uplifts socially and economically backward families.

- Creates employment opportunities among women even in special categories.

- Minimal documentation and easy process makes it very accessible.

- The policy provides financial assistance to self help groups and single women.

- The scheme also provides loans to self help groups with 20 members and above.

- Maximum loan amount for a single woman beneficiary is Rs. 1,40,000/-

- Self help groups or beneficiaries get the loan directly.

- The benefits are:

- It improves rural women’s economic condition.

- Supports business of socially isolated people.

- BPL families get special benefit.

- More employment opportunities to minorities due to the scheme.

- Support successful women entrepreneurs.

- Simple registration process with minimal document exchange.

FAQ Related Mahila Samriddhi Yojana

What is Mahila Samriddhi Loan Yojana?

Mahila Samriddhi Yojana is a micro loan scheme for women entrepreneurs of BPL or backward classes of the society under NBCFDC.

What is the loan tenure of Mahila Samriddhi Loan Yojana?

The loan tenure is 4 months from the date of loan disbursal in which the borrower has to complete all the formalities related to utilization of disbursed amount.

What is the maximum amount under Mahila Samriddhi Loan Yojana?

The loan tenure under this Mahila Samriddhi Yojana is up to 48 months or 4 years. This includes a moratorium period of maximum 3 months. The maximum loan amount a single beneficiary woman can get is Rs. 1,40,000/-.

What is the interest rate under Mahila Loan Samriddhi Yojana?

The interest rate is 1% for SCAs and 4% for beneficiaries.

What is the minimum age to apply for Mahila Samriddhi Loan Yojana?

Minimum age to apply for Mahila Samriddhi Yojana is 18 years.

Is caste certificate required to apply for Mahila Samriddhi Loan Yojana?

Yes, caste certificate is mandatory. If you don’t have one, you can visit the concerned department and talk to the officials to get one.