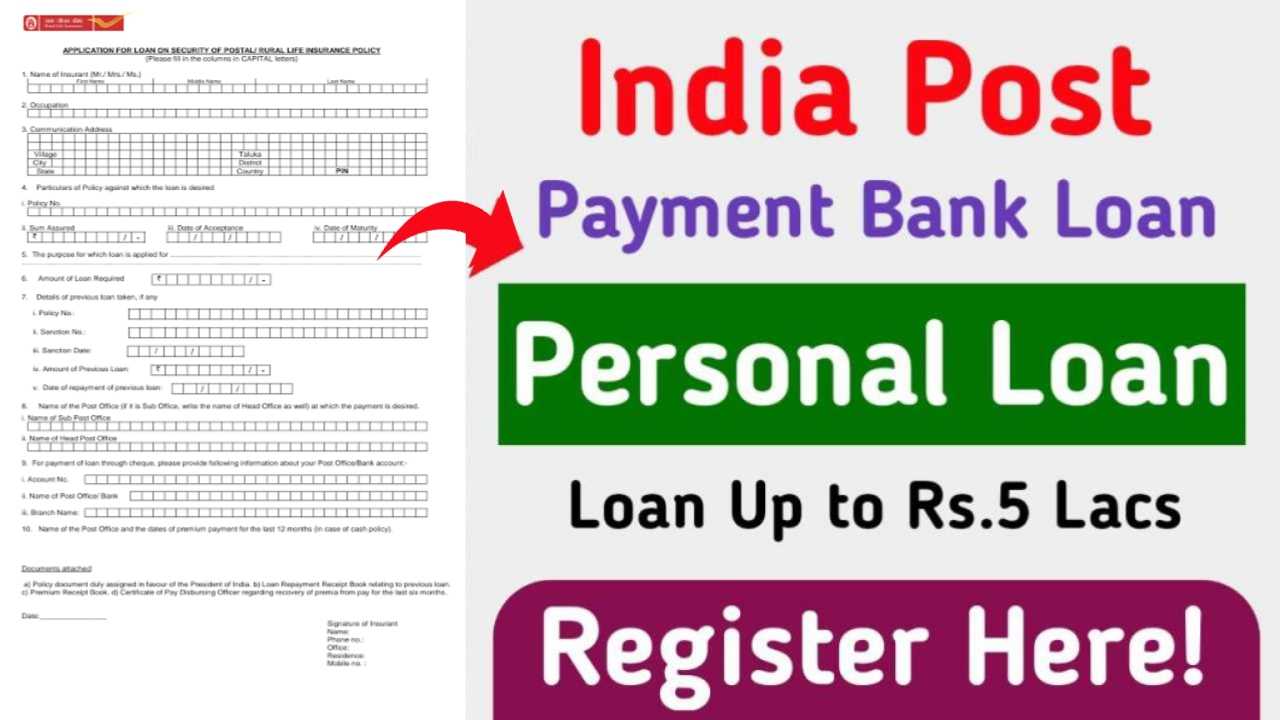

India Post Payment Bank Loan: You need a loan for your work but confused where to get the loan from! Then you must go for India Post Payment Bank loan. India Post Payment Bank is giving loans from Rs 50,000 to Rs 5 lakh to its customers. And the interest rate will be very low.

In this post we will know how to apply for this loan? And what will be the interest rate? Read the whole post to know. Follow the below process for fast loan approval.

PMEGP Loan Aadhar Card: Get Rs.10 Lacs Loan with Aadhar Card

India Post Payment Bank Loan Apply Official Website

Table of Contents

Overview of India Post Payment Bank Loan

| Article Name | IPPB Will Give Loan For Personal, Home and Business Loan |

| Yojana Name | India Post Payment Bank Loan |

| Launched By | Indian Post |

| Beneficiary | India Post Bank Customer |

| Benefit | Get Loan Up to Rs.5 Lacs |

| Help Line No. | 155299, 18001807980 |

| Official Portal | Click Here |

What is India Post Payment Bank Loan?

India Post Payment Bank is offering home loan, personal loan, business loan, gold loan and vehicle loan to its customers. Here you can take a loan from Rs 50000 to Rs 5 lakh. The best thing is that this loan is very easily available and at low interest rate so it becomes easy to repay.

Loan application process through India Post Payment Bank is very simple. Here you just need to give an online service request to India Post Payment Bank and then the postman will come to your home and approve your personal loan.

Features and Benefits of Scheme

- Just fill a service request online.

- You get small loan to big loan very fast.

- More convenient for rural people.

Eligibility Criteria

- The applicant must be an Indian citizen.

- The applicant must have a source of income.

- Min. age of applicant should above 18 years.

Documents Requirement

- Aadhar Card

- Residence Certificate

- Address Proof

- PAN Card

- Bank Passbook

- Mobile Number

- Passport Size Photo

Registration Process for India Post Payment Bank Loan

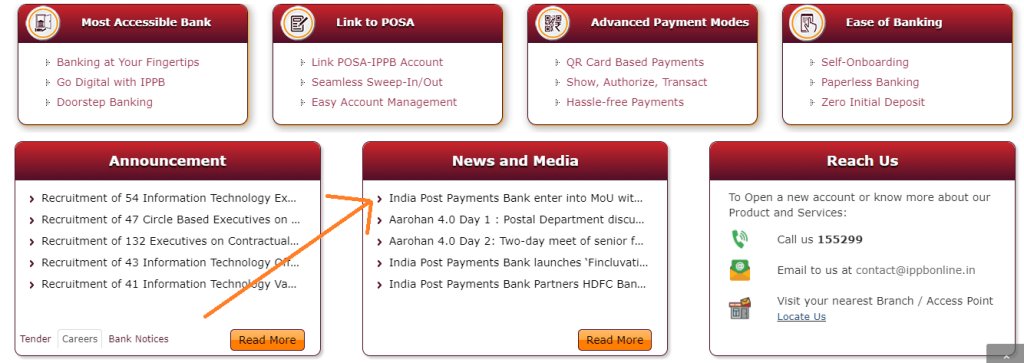

- Go to India Post Payment Bank Website.

- IPPB home page will open in front of you with many options in the menu.

- Out of these options click on Service Request.

- If you have an account in India Post Payment Bank click on IPPB Customer if not click on Non IPPB Customer.

- After clicking on IPPB Customer DOORSTEP BANKING SERVICE REQUEST FORM will open in front of you.

- If you have clicked on Non IPPB Customer, then click on DOORSTEP BANKING and proceed.

- First of all check what kind of loan you want. If it is personal loan then click on Personal Loan and fill the form below.

- After filling the form tick on I agree to terms & conditions below and enter the Text Verification code below.

- Click on Submit.

- Service Request will be submitted for your loan.

- After submitting the form you will get a call from post office in which some information will be taken from you.

- Then either postman will come to your home or you have to go to your nearest post office and tell the information and submit all documents there.

- Then you should wait for few days. If everything is correct then your loan will be approved and loan amount will be credited to your bank account.

India Post Payment Bank Loan Interest Rate

India Post Payment Bank has not given any information about the interest rates yet. But it is expected that the interest rate will be based on the loan amount. The interest rate of the loan you will take will be decided accordingly. This interest rate will be lower than the bank interest rate. Because it’s for rural people.

FAQ Related India Post Payment Bank Loan

What are the loans offered by IPPB?

IPPB does not offer any loan products directly. However it offers third party loan services through tie ups with other banks and financial institutions. These include personal loans, business loans and agricultural loans.

What are the eligibility criteria for IPPB loans?

Eligibility criteria for IPPB loans vary depending on the loan product and the partner institution. Income, credit history, business financials and collateral may be considered. IPPB customers can check the eligibility criteria for different loan options at their nearest post office branch.

What is the interest rate for IPPB loans?

Interest rates for IPPB loans are decided by the partner institutions and vary. Customers should check the current interest rates and compare offers from multiple institutions to get the best deal.

How to apply for IPPB loan?

To apply for a loan through IPPB, customers can visit their nearest post office branch and meet the representative. The representative will guide them through the application process and help them submit the documents.