District Industry Center: The main objective of District Industries Centre is to create employment in rural India. District Industries Centres was launched by Central Government in 1978 to promote small, cottage, village and small scale industries (SSI) in small towns and provide them all basic facilities, services and amenities in specific areas.

District Industries Centres are managed and run at district level to provide all support services to entrepreneurs or first time entrepreneurs to start their small and medium enterprises (MSMEs). District Industries Centre also promotes registration and development of industrial cooperatives.

Get Rs.50,000 Loan For Starting Your Business, Apply Online

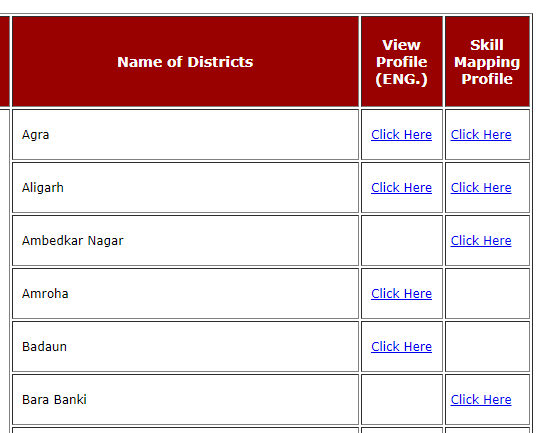

District Industry Center 2024 Application Form Official Portal

Table of Contents

Overview of District Industry Center

| Article Name | Loan Scheme, Online Application, Application Form |

| Yojana Name | District Industry Center 2024 |

| Launched By | Govt of India |

| Beneficiary | SC, OBS, Physical Handicap for Small Businesses |

| Benefit | Get Loan Up to Rs.30Lacs |

| Help Line No. | Click Here |

Eligibility Criteria

Below are the eligible entities:

- SC, Safai Karam Chari, OBC

- Physically Handicapped professionals like Engineers, Doctors, Pathologists, Chartered Accountants, Advocates, Physiotherapists, Architects etc.

- Nationality: Indian only.

- Age: 18 years or above.

- Education: Must have required education, technical skills and experience for the project.

- No Default: Not a defaulter of any bank or financial institution.

- No Other Subsidy: Not availed any other subsidy or benefit under any other scheme for the same project.

- Viable Project: Have a viable project report and able to contribute the required margin money and collateral security (if applicable) for the project.

Benefits of DIC Scheme

- Seed Money: Up to ₹10 lakhs, 15% seed money.

- Interest Subvention: 35% interest subvention for special categories (SC/ST/OBC/Minorities/Women, Ex-servicemen, Physically handicapped, NER, Hill and Border areas, etc.).

- Cashback: Cashback of up to ₹1,200 per annum for digital transactions.

- Training: Entrepreneurship Development Training for potential and existing entrepreneurs to learn project identification, feasibility study, market survey, financial management and quality control.

Documents for the District Industry Center Loan

- ID Proof like Aadhaar Card, Voter ID, PAN Card, Passport.

- Address Proof in which Ration Card, Electricity Bill, Water Bill, Telephone Bill will consider.

- Education Certificates and mark sheets.

- Experience certificate from previous employers.

- Project report with project cost, financials, market analysis.

- 6 months bank statements.

- Business plan with objectives, strategies and financials.

How to Apply for DIC Scheme

- Visit DIC Website: Go to Udyam Registration Portal.

- Fill Application Form: Fill the application form completely.

- Upload Documents: Upload identity proof, address proof, educational certificates, experience certificate, project report, bank statements and business plan.

- Submit the application and wait for DIC to process it.

- DIC will verify the application and will contact the applicant for any further information or clarification.

- After approval of application, loan will be disbursed to the applicant.

FAQ Related District Industry Center Loan

What is DIC Loan Scheme?

The main objective of DIC Loan Scheme is to support and promote small, tiny, cottage and village industries in India. The scheme aims to create jobs, improve competitiveness, empower entrepreneurs and overall economic growth.

Who can apply for DIC Loan?

DIC Loan Scheme is open to Indian citizens who have completed 18 years of age and have required educational qualifications, technical skills and experience for the project.

What are the benefits under DIC Loan Scheme?

The benefits under DIC Loan Scheme are seed money support up to 15% for ventures up to ₹10 lakhs, interest subvention up to 35% for special categories, cashback up to ₹1,200 per annum for digital transactions and Entrepreneurship Development Training Programs.

What are the documents required to apply for DIC Loan?

The documents required for DIC Loan Scheme application are identity proof, address proof, educational certificates, experience certificate, project report, bank statements and business plan.

How to apply online for DIC Loan?

Entrepreneurs can apply for DIC Loan through Udyam Registration Portal. The online application process is to fill the application form, upload documents and submit the application. DIC will verify the application and will contact the applicant for any additional information or clarification before disbursement of loan.