The Mudra Loan: In the changing landscape of Indian economy small businesses play a big role especially in rural areas where entrepreneurship can uplift the community. Pradhan Mantri Mudra Yojana (PMMY) was launched on April 8, 2015 to provide financial support to these micro enterprises so that they can grow and contribute to local economy. By providing loans without collateral the scheme empowers individuals to start or expand their business and be self reliant and innovative.

Mudra loan is divided into three products – Shishu, Kishore and Tarun each designed for different stages of business. This structured approach simplifies the borrowing process and ensures that entrepreneurs get tailored support as per their requirement. As rural entrepreneurs want to tap their potential, understanding Mudra loan is essential to unlock opportunities and growth in their community.

District Industry Center 2024: Know Everything About Loan Scheme

India Post Payment Bank Loan 2024: IPPB Will Give Loan For Personal

Table of Contents

Overview of The Mudra Loan Initiative

| Article Name | The Mudra Loan Initiative for Small Scale Businesses |

| Yojana Name | PM Mudra Loan |

| Launched By | Indian Govt |

| Beneficiary | Small and Medium Entrepreneur |

| Benefit | Get Loan Up to Rs.10 Lacs |

| Help Line No. | 022 67531100/1465 |

| Official Portal | Click Here |

What is The Mudra Loan?

Mudra loans are financial products under PMMY to support micro and small enterprises in non-farm sector. The loans can be used for starting a new business, meeting working capital requirements or expanding existing business. With a maximum loan amount of up to ₹10 lakh, these loans are available through various financial institutions like banks, Non-Banking Financial Companies (NBFCs) and Micro Finance Institutions (MFIs).

Categories of The Mudra Loan

- Shishu: For new businesses requiring up to ₹50,000. Ideal for startups looking for initial funding to purchase equipment or raw materials.

- Kishore: For established businesses needing funds between ₹50,001 and ₹5 lakh for expansion or working capital.

- Tarun: For fully established businesses that require larger amounts between ₹5 lakh to ₹10 lakh for further growth and diversification.

Benefits of The Mudra Loan

Mudra loans have several benefits that make them attractive for rural entrepreneurs:

- Collateral Free: One of the biggest advantage is that these loans don’t require any collateral or security, so even those who don’t have assets to pledge can avail.

- Flexible Repayment Terms: Borrowers can choose repayment tenures from 12 months to 5 years, so they can manage their cash flow better.

- No Processing Fees: Many banks waive off processing fees for Shishu loans, so less financial burden on borrowers.

- Diverse Activities: The scheme covers various activities like manufacturing, trading, services and agriculture related ventures.

- Women Entrepreneurs: Special provisions and interest rate reduction for women entrepreneurs, so more gender inclusivity in business.

Eligibility Criteria

To apply for Mudra loan you must meet the following criteria:

- Age: 18 to 65 years

- Business: Individuals, sole proprietorships, partnerships, private limited companies and all other legal entities engaged in manufacturing or services.

- Credit: No default with any financial institution and ideally good credit history.

- Documents: Aadhaar card, passport, utility bills, business registration documents, income tax returns for last 2 years, bank statements.

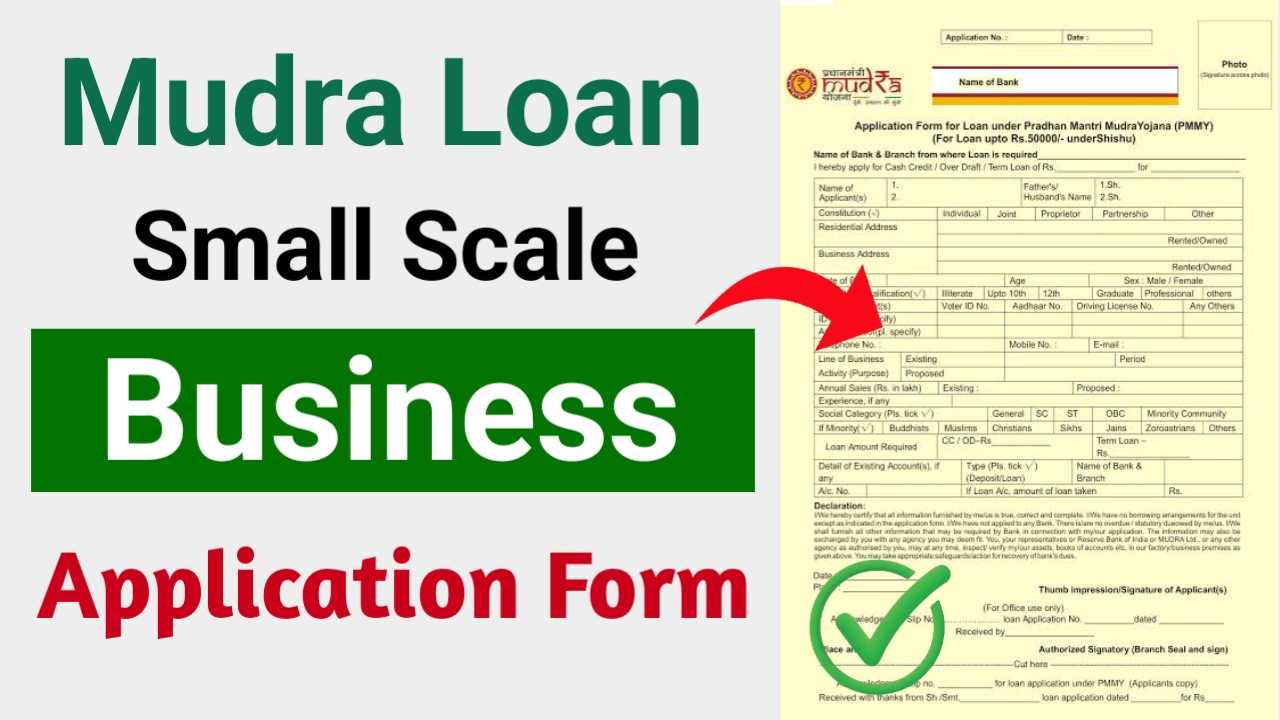

How to Apply For The Mudra Loan

Mudra loan application process is simple:

- Choose the Right Category: Select the loan category (Shishu, Kishore, Tarun) as per your business requirement.

- Collect Documents: Collect all the documents as mentioned in the eligibility criteria.

- Visit Website: Go to PMMY website or website of your chosen bank/NBFC/MFI.

- Fill the Form: Fill the application form with accurate business and personal details.

- Submit: Submit the application along with documents online or at a branch of your chosen bank/NBFC/MFI.

- Wait: After submission your application will be reviewed by the lender who will verify the documents and approve the loan.

- Get the Funds: Upon approval funds will be credited into your bank account.

Problems faced by Rural Entrepreneurs

Despite the benefits of Mudra loans, rural entrepreneurs face problems that can hinder them from utilizing the funds effectively:

- Lack of Financial Awareness: Many borrowers may not know the application process or how to manage the loan.

- Limited Information: In rural areas information about financial products is limited.

- Market Constraints: Rural businesses may not have access to market due to infrastructure or competition from bigger companies.

Conclusion

Mudra loan is a big step towards empowering small businesses in rural areas. By providing collateral free financing it promotes entrepreneurship and development at grass root level. But for this to reach its full potential, we need to work on financial awareness among rural entrepreneurs and information about available resources.

As India becomes self reliant, Mudra loans will be a key driver of micro enterprises that will create employment and sustainable growth in rural areas.