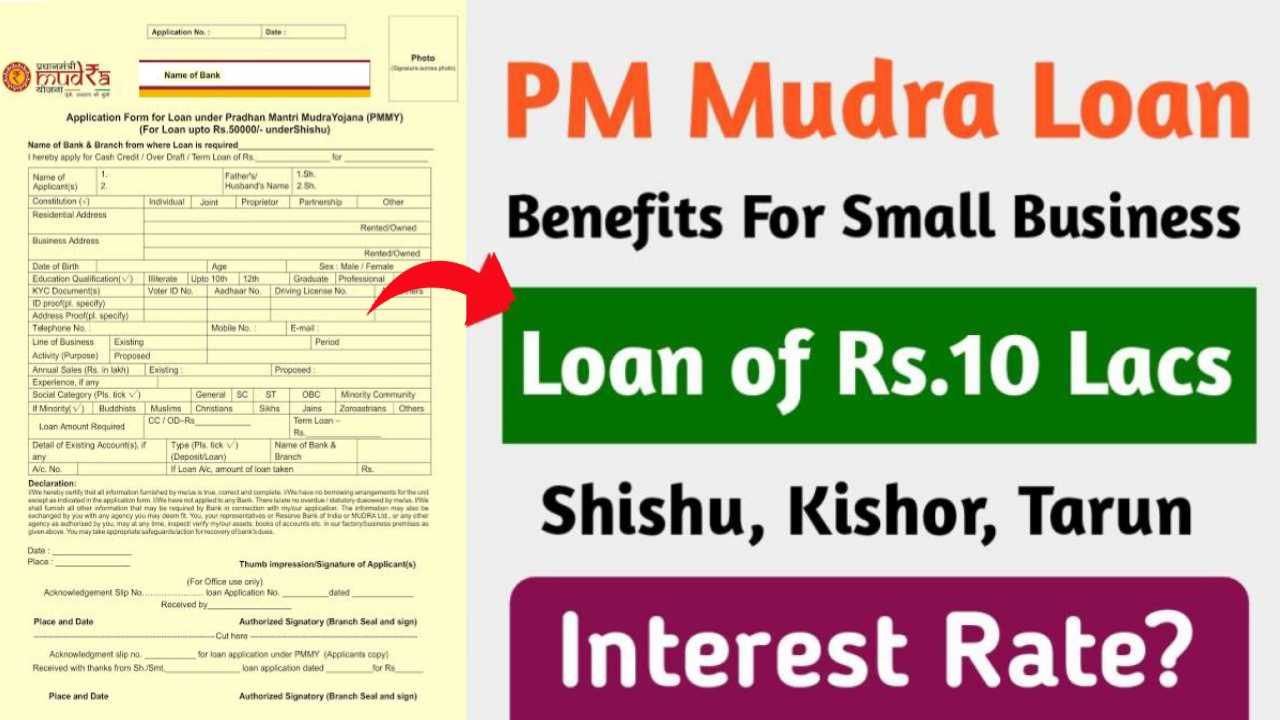

PM Mudra Loan: A major help to the expansion and financial stability of small enterprises in India is the Pradhan Mantri Mudra Yojana (PMMY). It allows micro and small companies (MSEs) to obtain financing without pledging assets by offering collateral-free loans up to ₹10 lakh.

The scheme has three types of loans – Shishu, Kishor and Tarun – for different stages of business. This flexibility allows entrepreneurs to choose the funding that suits their needs whether it is to start or scale up. Also it promotes financial inclusion so that businesses in remote areas can grow and contribute to the economy. Follow the below process for fast loan approval.

Get Financial Assistance Up to Rs.20 lakhs For Studying Abroad

Read More: PM Mudra Loan Scheme Official Website Link

Table of Contents

Overview of PM Mudra Loan

| Article Name | Benefits of PM Mudra Loan for Small Businesses in 2024 |

| Yojana Name | PM Mudra Loan |

| Beneficiary | Citizen of India |

| Benefit | Providing Loan Assistance to New Businesses |

| Official Portal | Click Here |

Types of PM Mudra Loan Scheme

There are 3 types of loan offering under Mudra Loan Scheme.

Shishu Loan

Shishu loans are for startups and micro enterprises, up to ₹50,000. This is good for entrepreneurs who want to start a business without high financial risks. Quick and easy application process allows new businesses to get funds fast for immediate operational needs.

Kishor Loan

Kishor loans are ₹50,001 to ₹5 lakh, for businesses that have gone beyond the startup phase. This is good for small businesses that want to expand, buy inventory or enhance their services. Kishor category provides more financial backing but still accessible.

Tarun Loan

Tarun loans are for established businesses, ₹5 lakh to ₹10 lakh. This is for businesses that need big capital for bigger projects or expansions. Tarun loans allows entrepreneurs to invest in technology, infrastructure or other key assets that can drive growth and competitiveness.

Interest Rates Under PM Mudra Loan

Pradhan Mantri Mudra Loan interest rates vary depending on the loan category—Shishu, Kishor and Tarun. Here’s a quick glance:

Shishu Loans:

- Amount: Up to ₹50,000

- Interest Rate: 1% to 12% per annum

Kishor Loans:

- Amount: ₹50,001 to ₹5 lakh

- Interest Rate: 8.60%

Tarun Loans:

- Amount: ₹5 lakh to ₹10 lakh

- Interest Rate: 11.15% to 20%

Interest rate will vary based on your creditworthiness, market conditions and lender’s policies. Most importantly, these loans are unsecured, no collateral required, so many entrepreneurs can avail it to expand their business or start a new venture.

Loan Repayment Tenure for Shishu, Kishor, and Tarun Loans

PM Mudra Loan Repayment Terms:

- Shishu Loans: For Startups and Early Stage Business, Repayment up to 7 years. This gives the borrower time to establish the business without any immediate pressure.

- Kishor Loans: For businesses that have expanded and need more funds, Kishor loans have a repayment tenure of 5 to 7 years. This gives time for the larger loan amount and a manageable repayment schedule.

- Tarun Loans: For established businesses looking for large funds, Tarun loans have a repayment tenure of 3 to 5 years. This is for larger loan amount and established cash flows from the business.

Document Requirements for Shishu, Kishor, and Tarun PM Mudra Loans

Shishu Loans

- Identity documents: voter ID, passport, Aadhar card, and PAN card.

- Utility bills, rent agreement, and Aadhar card are examples of address proof.

- Trade license or GST serve as proof of business ownership.

- Project report with predicted results and loan purpose included in the business plan.

- Bank Statements: The statements for the last six months.

- Income proof can be shown via self-employed financial statements or income tax returns.

- Extra Documentation: As stipulated by the bank.

Kishor Loans

- Identity documents: government ID, PAN card, and Aadhar card.

- Utility bills and property records serve as evidence of address.

- Trade license, GST registration for businesses.

- Financial Statements: Income tax returns and recent bank statements.

- Business Plan: The loan’s intended purpose for expanding the company.

- Additional Documents: Per the lender’s specifications.

Tarun Loans

- Aadhar, PAN, and voter ID cards are examples of identity proof.

- Utility bills or other official documents displaying the address serve as address proof.

- Trade licenses, GST registrations, and Udyam Registration Certificates serve as business proof.

- Financial Records: Detailed financial records, such as income tax returns and bank statements.

- Project Report: Detailed loan-related business strategy with anticipated results.

- Extra Documents: Any other files the lender requests.

These will assist the lender in determining the borrower’s eligibility and the nature of the firm seeking the loan.