PMEGP Loan: Government will give loans to unemployed people for a fixed time so that all the youth can start a business as per their interest. Central government gives this loan to persons one who has Aadhar card. So Aadhar card is must. When loan is approved all the persons will be given the amount at minimum interest rate.

Government wants all the people of the country to get employment and improve their condition so PMEGP loan facility has been started. On applying for PMEGP loan you will be given training and then you will get the loan. You must attend the training to get the loan. Follow the below process for fast loan approval.

Get Rs.25 Lacs Loan From Bank Without Guarantee

PMEGP Loan Aadhar Card Online Official Portal

Table of Contents

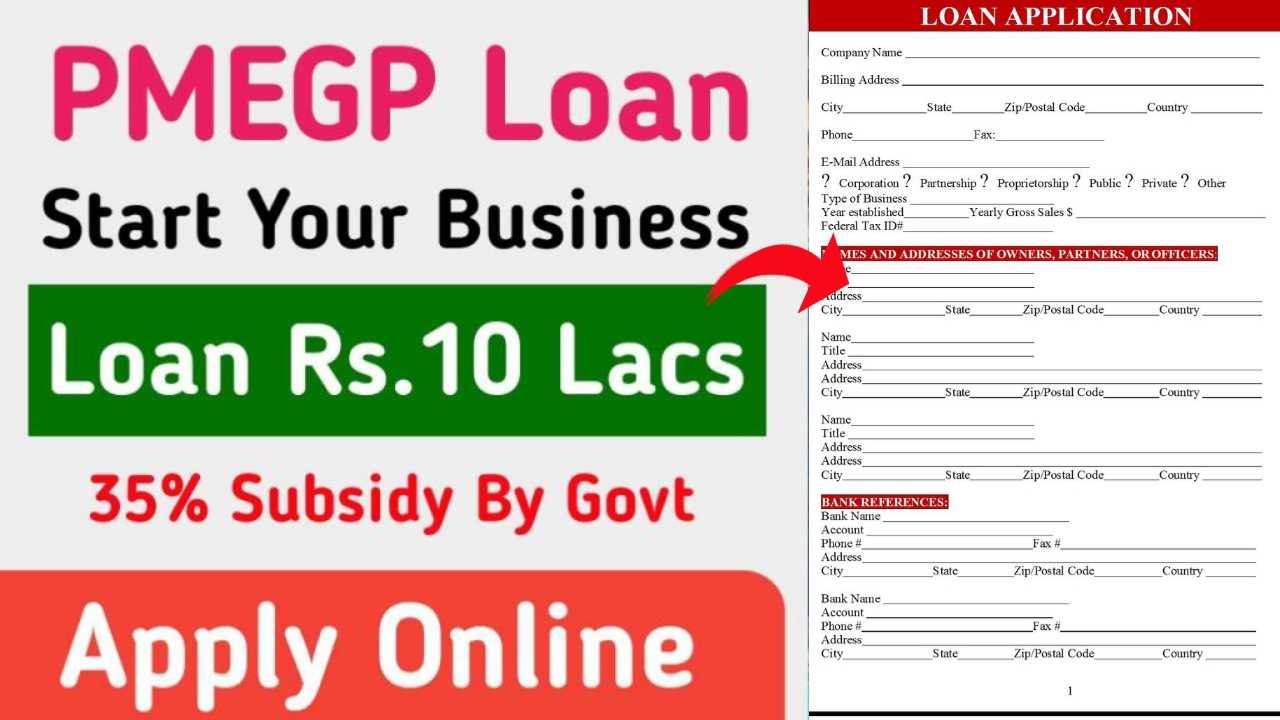

Overview of PMEGP Loan

| Article Name | Get Rs.10 Lacs Loan, Govt Subsidy By 35% |

| Yojana Name | PMEGP Loan Scheme |

| Launched By | Govt of India |

| Beneficiary | Micro Entrepreneurs in India |

| Benefit | Get Loan Up to Rs.10 Lacs |

| Official Portal | Click Here |

What is PMEGP Scheme?

Government will provide a loan of up to ₹ 10 lakh to make the youth of the country self reliant and start their own business. Under PMEGP loan amount is available at minimum interest rate which is good for all. Under this scheme government will give 35% subsidy in rural and 25% in urban areas. PMEGP loan condition are very easy so that you can pay loan back with help of subsidy offered by Govt.

Benefits of PMEGP Scheme

- Small, micro and medium entrepreneurs will get loans.

- Loans up to Rs 10 lakh.

- Loans will be subsidized as per rules.

- 35% in rural and 25% in urban.

PMEGP Scheme Age and Education

To get PMEGP loan educational qualification and age limit is required as per government. This loan is given to youth who have completed their primary education i.e. 10th or 12th. PMEGP loan is given to youth between 18 to 40 years so that they can grow in business.

PMEGP Scheme Eligibility

- To get PMEGP loan candidate will need qualifications in business.

- Loan with Aadhar card is available only to Indian citizens and beneficiary must be an Indian citizen.

- Candidate should be 10th pass

Documents Requirement

- Aadhaar Card

- PAN Card

- Caste Certificate

- Bank Passbook

- Marksheet

- Email ID

Online Registration Process

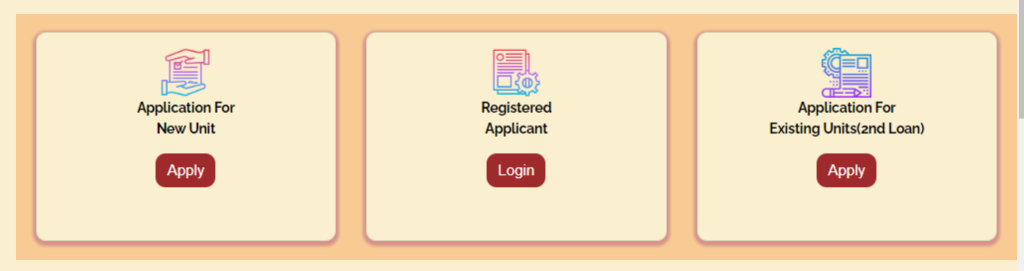

- To apply for PMEGP scheme you have to visit official website first.

- Then click on PMEGP loan link.

- Then enter all the details asked in registration form.

- Then upload all the documents.

- After this, you have to click on submit.

- Now after verification of your form, the loan amount will come to your bank account.

FAQ Related PMEGP Scheme

What is the maximum project cost under PMEGP?

Maximum project cost under PMEGP is Rs. 25 lakhs for manufacturing units and Rs. 10 lakhs for service units.

Who are eligible for PMEGP?

Individual entrepreneurs, institutions, co-operative societies, self-help groups, trusts are eligible for PMEGP.

What is the margin money (government subsidy) under PMEGP?

Margin money (government subsidy) under PMEGP is 15% of the project cost for general category and 25% for special category (SC/ST/OBC/Minorities/Women, Ex-servicemen, Physically handicapped, NER, Hill and Border areas etc.)

Is EDP training compulsory under PMEGP?

Yes, EDP (Entrepreneurship Development Program) training of 10 days for project cost more than Rs. 5 lakhs and 6 days for project cost up to Rs. 5 lakhs is mandatory for beneficiaries before claiming margin money (subsidy) through PMEGP portal.

Is collateral security required under PMEGP?

No, collateral security is not required for PMEGP loans up to Rs. 10 lakhs. For loans above Rs. 5 lakhs and up to Rs. 25 lakhs, Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) provides collateral guarantee.