SBI Stree Sakti Yojana: Government makes schemes time to time to empower women. State Bank of India which is the biggest bank of India has launched a scheme called Stree Shakti Yojana in collaboration with government. The scheme helps women to become self dependent by giving them loans at very low interest rate to start their own business.

These loans can be used by women to start their own business. SBI Stree Shakti Yojana 2024 will make it easy for women to work. If you are a woman and want to take advantage of this scheme of State Bank of India then read this article to know more about it. Follow the below process for fast loan approval.

Loan of Rs.3 Lacs at Just 4% Interest Rate, Detailed Information

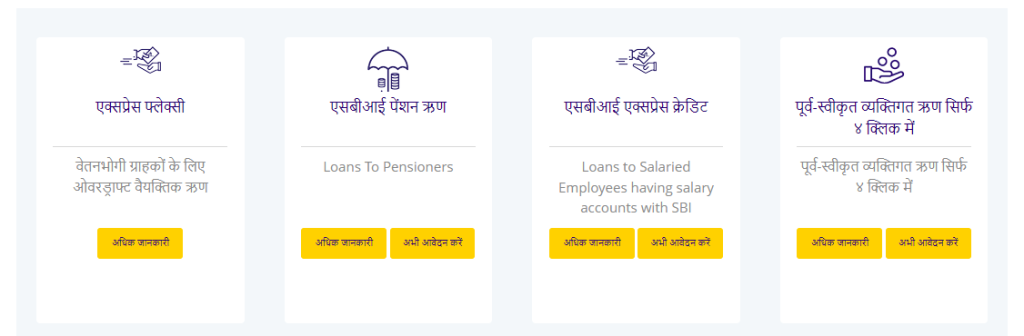

SBI Stree Sakti Yojana Official Portal Of SBI Bank

Table of Contents

Overview of SBI Stree Sakti Yojana

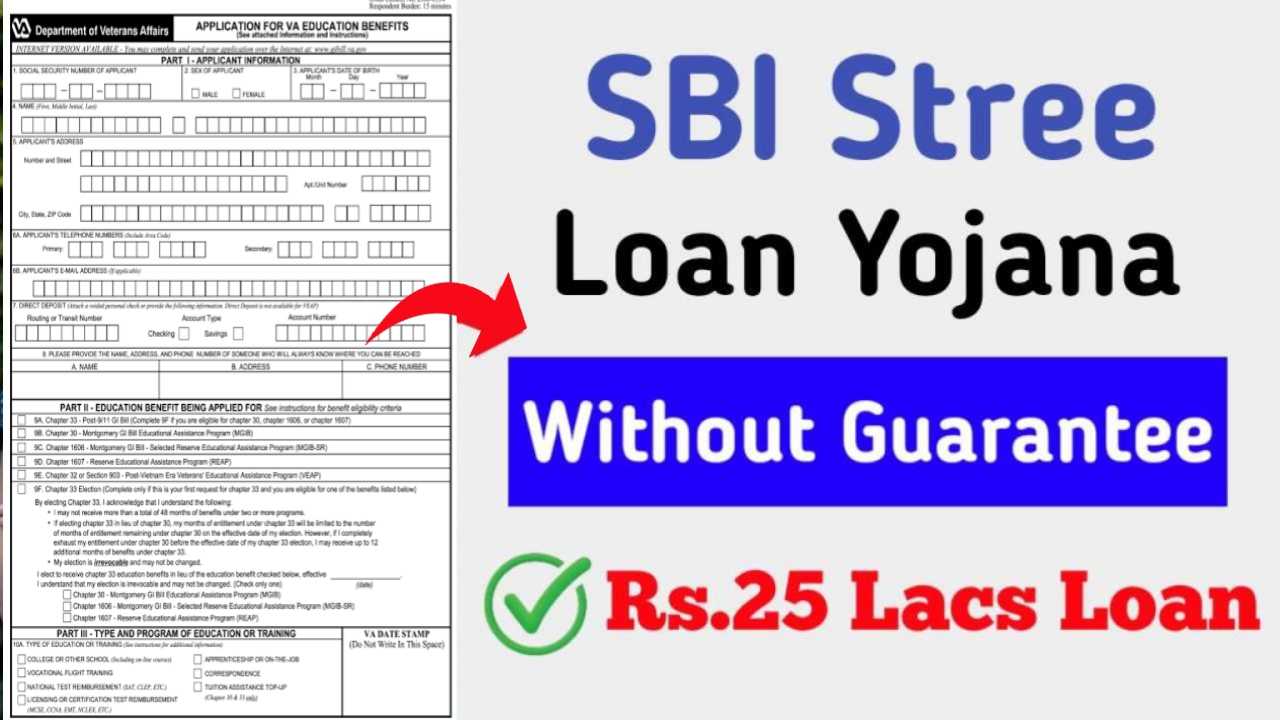

| Article Name | Get Rs.25 Lacs Loan From Bank Without Guarantee |

| Yojana Name | SBI Stree Sakti Yojana |

| Launched By | State Bank of India |

| Beneficiary | Women in India |

| Benefit | Get Loan Up to Rs.25 Lacs |

| Official Portal | Click Here |

What is SBI Stree Sakti Yojana?

State Bank of India in association with the government has launched a special scheme to empower women and make them self reliant. Under this scheme any woman who wants to start a business or job can borrow from the bank. They can borrow up to Rs 25 lakh which is a huge amount and they don’t have to pay much interest on it.

Here’s how it works: If a woman wants to start a business she must have at least 50% ownership in that business to be eligible for the loan. If the loan is less than Rs 5 lakh then the bank will not ask for anything valuable like a house or jewelry as a guarantee. But if the loan is between Rs 5 lakh to Rs 25 lakh then the bank will need some assurance that the woman will pay back the money.

Eligibility Criteria

To be eligible for SBI Stree Shakti Yojana 2024 you must:

- Be an Indian citizen.

- Apply for a loan for a new business.

- If you own 50% or more of an existing business you can apply for a loan under the scheme.

- Be the owner of your own business.

- Not apply for a loan on behalf of any other family member.

Businesses Included in SBI Stree Shakti Yojana

- Fruits and vegetables.

- Soaps and detergents (14C soap).

- Dairy farm and milk and dairy products.

- Clothes (shirts and pants).

- Papads (crunchy snacks).

- Fertilizers for gardening and farming.

- Small scale industry from home (handicrafts).

- Cosmetics (makeup and skin care products).

- Beauty parlor (haircuts and facials)

Documents Requirement

- Aadhaar card.

- Address proof.

- ID.

- Company ownership, if any.

- Application form.

- Bank statements.

- ITR for 2 years.

- Income certificate.

- Mobile no.

- Passport size photo.

- Business plan.

Registration Process for SBI Stree Sakti Yojana

If you are a woman and want to grow your business, apply for SBI Stree Shakti Yojana 2024. Here’s how:

- Go to your nearest SBI branch.

- Tell them you want to apply for SBI Stree Shakti Yojana.

- They will guide you through the process and ask for some details.

- Fill the application form given to you.

- Give all the required details, paste your passport size photo and sign where needed.

- Submit the application form along with all the documents.

- It will take a few days to process and if everything is fine, your loan will be approved.

- Then you can get SBI Stree Shakti Yojana.

FAQ Related SBI Stree Sakti Yojana

What is SBI Stree Shakti Yojana Loan?

SBI Stree Shakti Yojana is a loan scheme launched by Government of India in partnership with State Bank of India to support women entrepreneurs. Under this scheme women entrepreneurs can get loan up to ₹25 lakhs at low interest rate to start or expand their business.

What are the eligibility criteria for SBI Stree Shakti Yojana?

Business should be owned by a woman entrepreneur who should have minimum 50% stake in the company. Scheme is open to women entrepreneurs in retail trade, manufacturing, services and even professional fields like medicine, architecture and accounting.

What are the documents required for SBI Stree Shakti Yojana?

Proof of identity, proof of residence, proof of business address, financial statements and project reports (if applying for term loan). Collateral not required for loans up to ₹10 lakhs, may be required for loans above ₹10 lakhs.