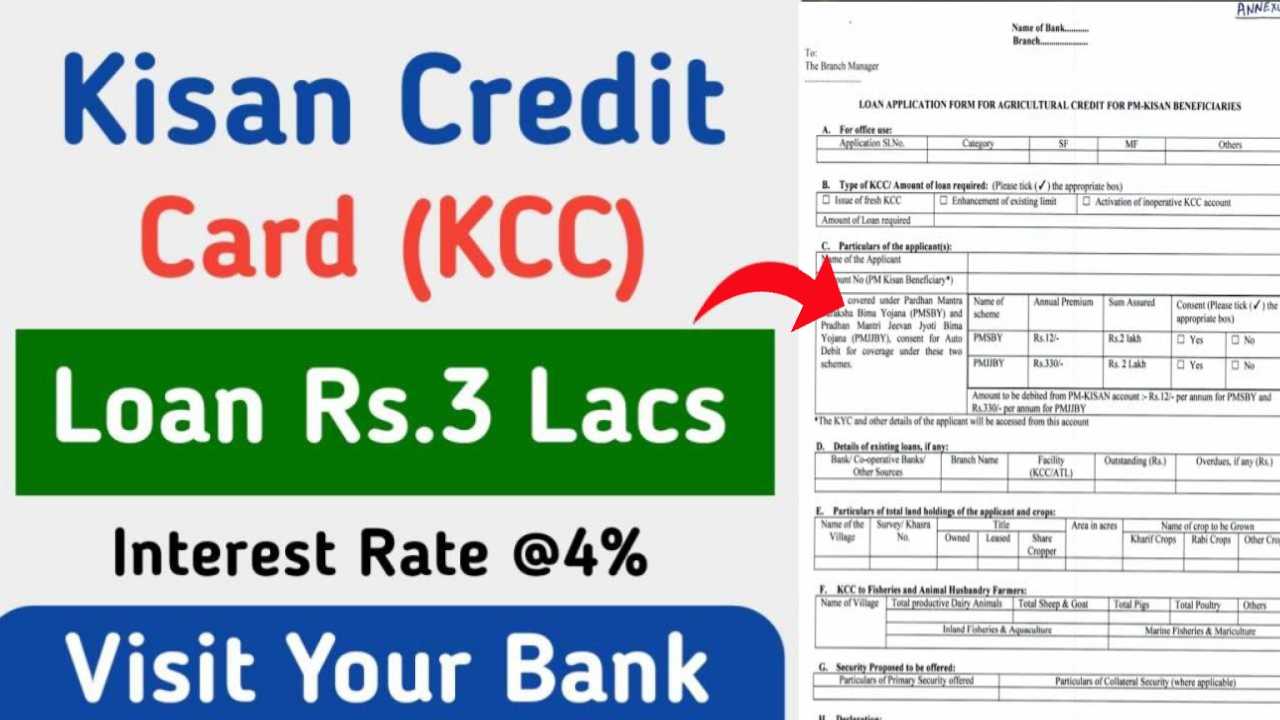

Kisan Credit Card: Farmers need money for farming. So they have to arrange money from somewhere. For which the government has launched ‘Kisan Credit Card (KCC) Loan Scheme’ for farmers. If you are also a farmer and don’t know about this scheme till now then perhaps you won’t be able to use this scheme. If you are a farmer then you must know about this scheme because this scheme is for special farmers only.

With this scheme you can take loan for farming at low interest by mortgaging your land anytime. This loan is also called Kisan Credit Card or Green Card. Kisan Credit Card Scheme is created by Central Government for farmers only. In this article we will provide you all the information about Kisan Credit Card Scheme through which you can take loan under this scheme. So read this article till the end. Follow the below process for fast loan approval.

PM Mudra Loan 2024: Get Rs.10 Lacs Loan For Your Business

Online Apply For Kisan Credit Card (KCC) Official Portal

Table of Contents

Overview of Kisan Credit Card

| Article Name | Loan of Rs.3 Lacs at Just 4% Interest Rate |

| Yojana Name | Kisan Credit Card (KCC) |

| Launched By | Govt of India |

| Beneficiary | Small and Micro Farmers |

| Benefit | Get Loan Up to Rs.3 Lacs @4% |

| Official Portal | Click Here |

What is Kisan Credit (KCC)

Kisan Credit Card is a loan given to farmers by banks at low interest, this scheme was started in 1998 by Government of India, Reserve Bank of India and NABARD, named Kisan Credit Card. If you have not taken loan from Kisan Credit Card Scheme before then you can go to your nearest bank and submit your land papers and take a loan for agriculture by filling up some other formalities.

In Kisan Credit Card Scheme 2022-23, a loan of up to Rs 3 lakh is available to farmers at 4% interest, to take a loan at 4% interest from this scheme some things have to be kept in mind, which we have mentioned below, so read this article till the end for more information about KCC scheme.

Benefits of KCC

- Kisan Credit Card Loan Scheme terms and conditions are much simpler than government loans in banks.

- Interest on Kisan Credit Card Loan is much less than other loans.

- Biggest advantage of Kisan Credit Card is that farmers are free from moneylenders because moneylenders have been exploiting farmers for long time.

- Under Kisan Credit Card Scheme farmers get loans at very low interest so they don’t need to take loans from moneylenders.

Interest Rate Under KCC

If you also take loan from Kisan Credit Card Yojana, then you must know about its interest rates and you have to keep in mind the date on which you took the loan. You have to pay the loan including interest before 1 year of the date on which you took the loan. By doing this you will be eligible to take loan from the very next day.

If you do this then you will get 3% interest discount on loan up to 3 lakhs from government, that’s why it is called the best loan. Total interest rate of Kisan Credit Card is 9% in which 2% is given by central government. Apart from this if you repay the loan before 1 year then you will also get an incentive of 3%.

Kisan Credit (KCC) Tenure

Kisan Credit Card works like an overdraft, where you can deposit money whenever you want and withdraw whenever you want. When you withdraw money, you have to pay interest. Kisan Credit Card is given for 5 years. After 5 years you can get it renewed by paying the interest.

What is overdraft?

Overdraft is a loan given by the bank to its customers, where money is withdrawn even if there is no money in the customer’s account. A fixed overdraft limit is set in this and the loan limit of this loan depends on the banks. When you withdraw money, you have to pay it back with interest.

Kisan Credit Card (KCC) Loan Scheme Documents

- Aadhar Card

- PAN Card

- Bank Account Passbook

- Income Certificate

- Residence Certificate

- Caste Certificate

- Land Documents

- Mobile Number and Photo

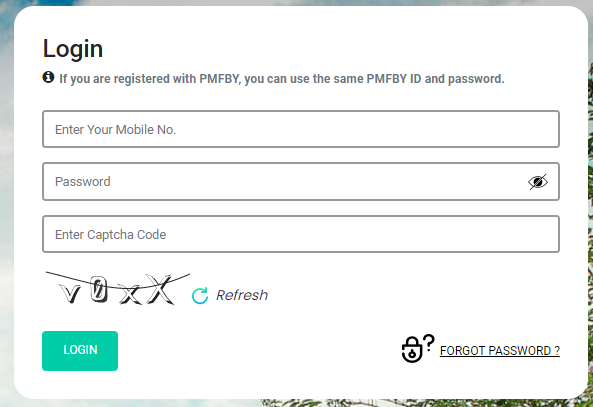

Online Apply For KCC

- Go to your nearest branch.

- Get the application form of this scheme.

- Fill the application form.

- Attach all documents.

- Submit the form.

FAQ Related Kisan Credit Card

What are the benefits of Kisan Credit Card (KCC) Scheme?

1. Short term credit for cultivation of crops, post harvest expenses and consumption needs.

2. Pre sanctioned credit limit on card for easy access to formal credit at lower interest rates than traditional lenders .

3. Covers activities allied to agriculture like dairy, inland fisheries etc. besides crop cultivation .

4. Flexible repayment options and no collateral required for loans up to ₹1.6 lakh .

5. Valid for 5 years, subject to annual review and limit enhancement based on credit history .

Who can avail KCC?

1. Individual farmers (owners/cultivators)

2. Sharecroppers and tenant farmers

3. Self-Help Groups (SHGs) and Joint Liability Groups (JLGs) of farmers

4. Farmers involved in animal husbandry, fisheries, etc.